Technology giants pour capital into AI startups, potentially avoiding antitrust concerns

22:30 25/05/2024

3 phút đọc

This week, the field of artificial intelligence (AI) continues to witness huge investments and sky-high valuations.

Photo source: GettyImages

DeepL , an AI language translation startup, raised $300 million at a $2 billion valuation. Scale AI, a data labeling platform for machine learning models, raised $1 billion and nearly doubled its valuation to $13.8 billion. H, a French startup developing proprietary AI models, raised a $220 million seed round at an undisclosed valuation (certainly putting H on the “unicorn” list. ” – unlisted startup valued at over 1 billion USD).

Besides familiar institutional investors such as Accel, Index and Y Combinator (YC), what is notable is the participation of large corporations. This is a sign that big players are scrambling to get into the AI space, but at the same time want to avoid regulatory scrutiny.

Type of “half-hearted merger”

Take Scale AI for example. This is a company that previously only raised capital from institutional and angel investors from 2016 until its Series E round in 2021. The Series F round still had participation from familiar investors, but also included Meta, Amazon, Nvidia and venture capital funds from Intel, AMD, Cisco and ServiceNow.

On the same day Scale AI announced its huge investor list, H also revealed that Amazon along with Samsung’s venture capital department and UiPath (an automation software company worth $10 billion) also participated in investing.

Large corporations investing in AI startups has been a big trend in recent years. A typical example is the relationship between Microsoft and OpenAI – the company that created ChatGPT. The deal has drawn scrutiny from antitrust regulators in Europe and the UK. They worry that tech giants are adopting new “half-merger” tactics to control and influence emerging technologies without outright acquisition – for example, through recruiting innovation teams. startup establishment or strategic investment.

https://www.bbc.co.uk/news/business-67657895

Microsoft is said to own 49% of OpenAI, meaning it will likely have to explain itself to European regulators once initial investigations are complete – regardless of whether Microsoft has voting rights in OpenAI or not. Are not.

Anthropic can also fall into a similar situation. The three-year-old company has raised more than $7 billion from a variety of investors, with participation from corporations such as Google, SAP and the venture capital funds of Salesforce and Zoom. But it’s worth noting that Amazon has spent more than half of Anthropic’s money raised to date, with a $4 billion investment in March. While the investment does not give Amazon control (similar to Microsoft with OpenAI), the UK antitrust regulator (CMA) last month confirmed it was reviewing the deal to see whether it is qualified to conduct an investigation.

At the same time, the CMA also revealed that it was investigating Microsoft’s acquisition of Inflection AI (one year after becoming Inflection’s largest investor). Microsoft has bought out Inflection’s founders and key employees to run a new consumer AI unit, leaving Inflection enterprise-only.

The CMA also confirmed that it is investigating Microsoft’s recent $16 million investment in French AI startup Mistral. However, the agency quickly concluded that the deal did not qualify for investigation due to its relatively small scale.

Nvidia, which was not grouped with other technology giants such as Apple, Google…, suddenly emerged as an important force in the field of artificial intelligence (AI). Nvidia’s market value has skyrocketed from $770 billion to more than $2.5 trillion in just one year, putting the company in third place globally, behind only Microsoft and Apple.

Nvidia is actively investing in AI startups such as Hugging Face, Cohere, Perplexity AI… Along with other giants, Nvidia is rushing into AI startups hoping to gain an advantage in the future. Although these investments may seem small, they allow giants like Nvidia to have a say and influence the development of startups.

Từ khoá:

Bài viết liên quan

Palm Mini 2 Ultra: Máy tính bảng mini cho game thủ

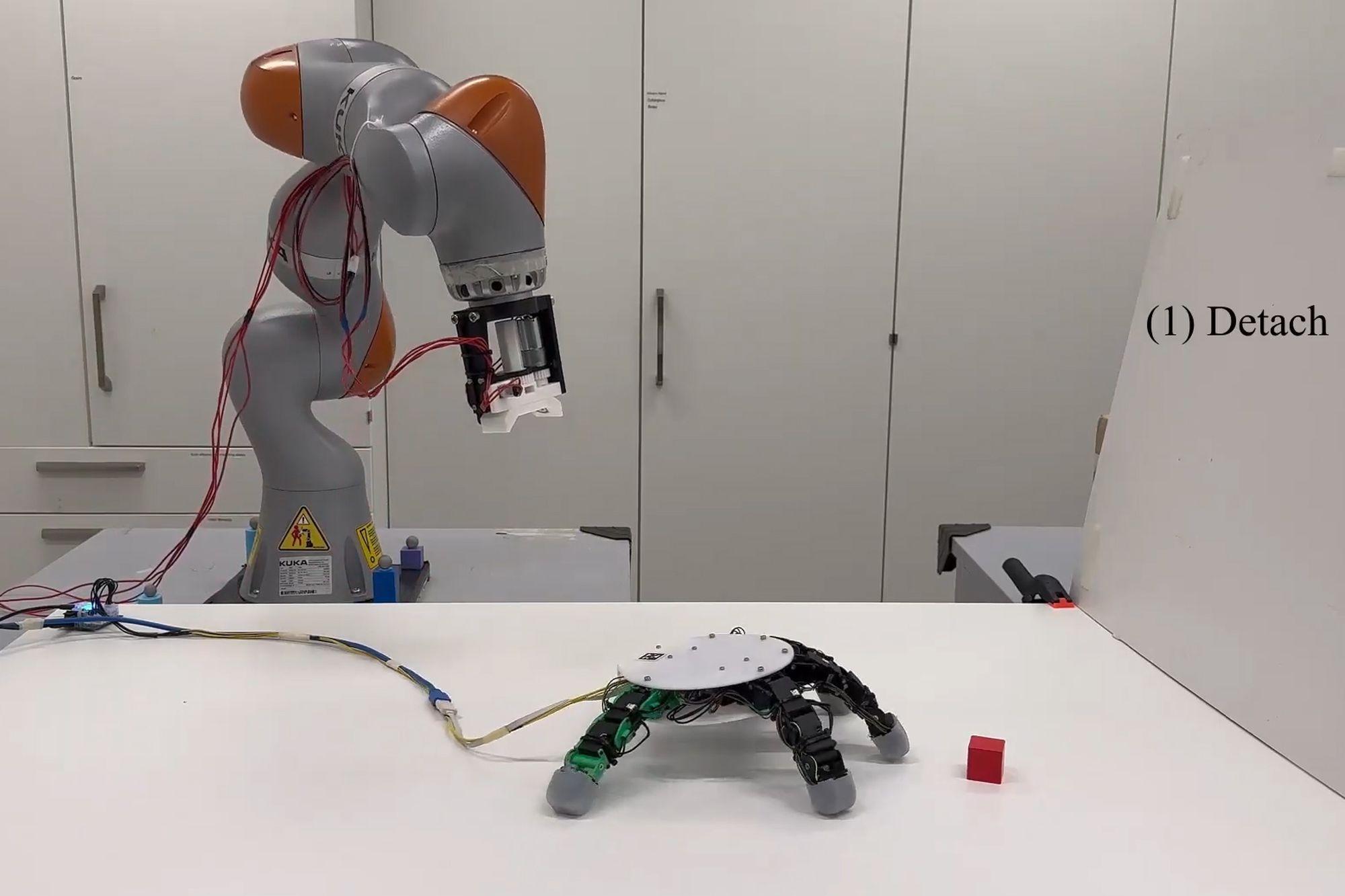

Robot with smart grip

NASA’s goal of conquering the Sun

Apple launches a new feature that makes it easier to use your phone while sitting on vehicle

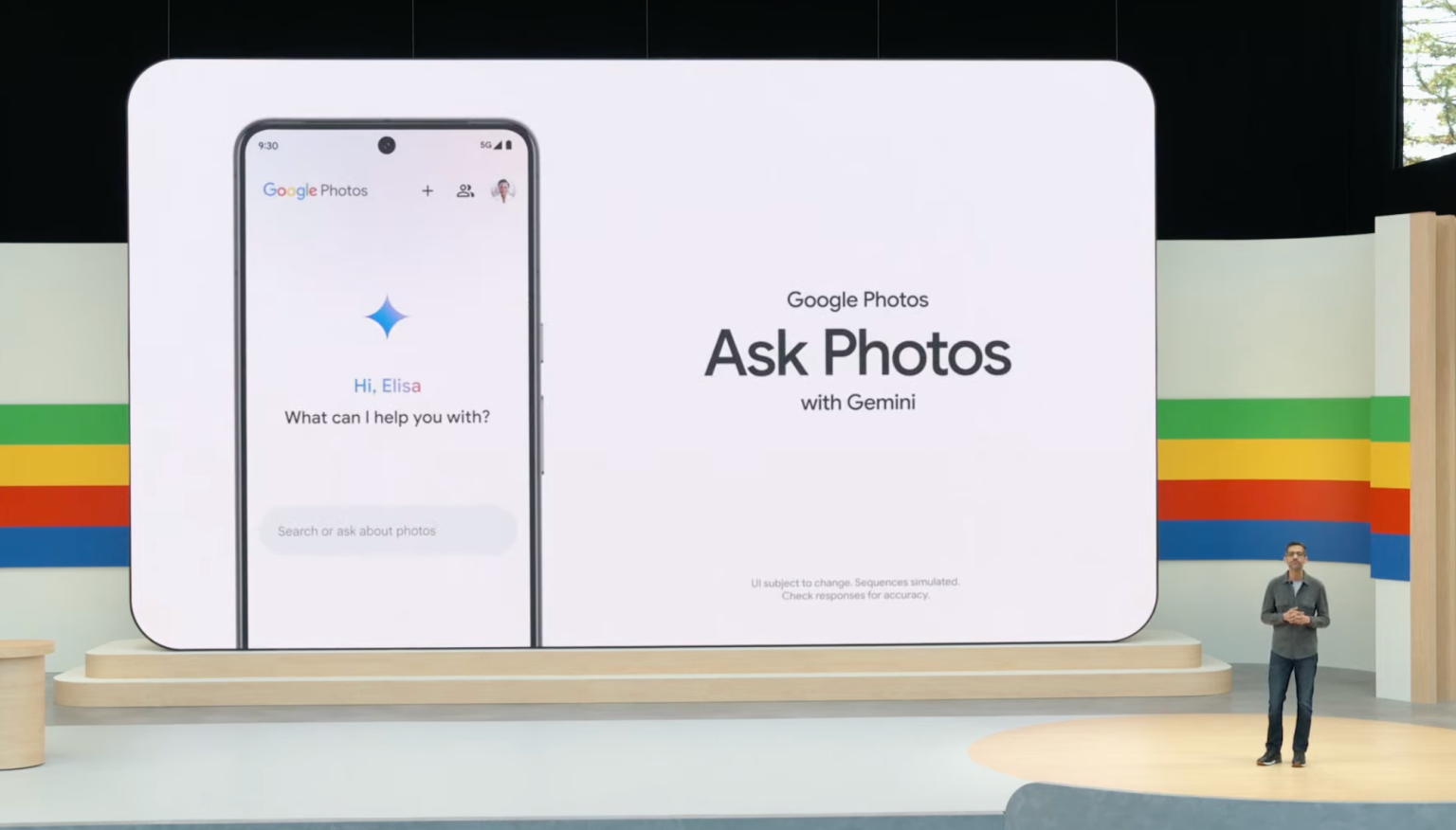

Google Photos launches smart search feature “Ask for photos”

Roku streams live MLB baseball games for free

Gun detection AI technology company uses Disney to successfully persuade New York

Hackers claim to have collected 49 million Dell customer addresses before the company discovered the breach

Thai food delivery app Line Man Wongnai plans to IPO in Thailand and the US in 2025

Google pioneered the development of the first social networking application for Android

AI outperforms humans in gaming: Altera receives investment from Eric Schmidt

TikTok automatically labels AI content from platforms like DALL·E 3

Dell’s data was hacked, revealing customers’ home address information

Cracking passwords using Brute Force takes more time, but don’t rejoice!

US lawsuit against Apple: What will happen to iPhone and Android?

The UAE will likely help fund OpenAI’s self-produced chips

AI-composed blues music lacks human flair and rhythm

iOS 17: iPhone is safer with anti-theft feature

Samsung launches 2024 OLED TV with the highlight of breakthrough anti-glare technology

REGISTER

TODAY

Sign up to get the inside scoop on today's biggest stories in markets, technology delivered daily.

By clicking “Sign Up”, you accept our Terms of Service and Privacy Policy. You can opt out at any time.

Nhận xét (0)