Synapse collapses, 10 million users at risk

09:50 26/05/2024

2 phút đọc

The financial technology (Fintech) startup market, which boomed in 2021, is now facing many difficulties, especially in providing banking services to third parties (Banking-as-a-Service, BaaS). .

The most notable event was the BaaS company Synapse declaring bankruptcy. This incident shows the fragility of the Fintech ecosystem when an important link has problems.

Synapse provides a service that allows other companies (mainly Fintechs) to integrate banking services into their products. For example, a company specializing in payroll for independent contractors used Synapse to provide instant payments.

Synapse was once considered a bright area of Fintech, raising more than $50 million from venture capital funds. However, by 2023, the company encountered difficulties, had to cut staff and filed for chapter 11 bankruptcy in April this year.

Plans to sell the assets to another Fintech company for $9.7 million also failed. As a result, Synapse is at risk of having to completely dissolve under chapter 7, affecting many other startups and customers.

For example, children’s banking startup Copper had to stop issuing accounts and debit cards due to its reliance on Synapse. This left many customers, mainly families, unable to access their funds.

Additionally, cryptocurrency app Juno and lending company Mainvest were also affected. According to estimates, about 100 Fintech companies and 10 million customers could ultimately be impacted by Synapse’s collapse.

https://mainvest.notion.site/Investor-Support-Hub-45c61ca735dd4daf8203c28d8945f9ff#3d543d9dcdf94df2b5dd6cacca0e16e3

This case shows the need for regulatory compliance and transparent operations in the Fintech sector. Banks also need to be more careful when choosing BaaS partners.

In addition, regulators need to have clearer regulations on consumer protection in the field of digital banking.

The collapse of Synapse may make banks (traditional and Fintech) more cautious about partnering with BaaS providers.

Fintech is a field that requires strict compliance with regulations. When companies take risks in a hurry, the ultimate losers are the users.

Massive investments in 2020 and 2021 caused many Fintech companies to grow rapidly to satisfy investors, despite regulatory compliance. The lesson learned from Synapse’s event is that Fintech needs to develop sustainably and comply with regulations. This incident may affect the ability of Fintech companies to raise capital in the future.

Tin tài trợ

- Vũ trụ

Premium

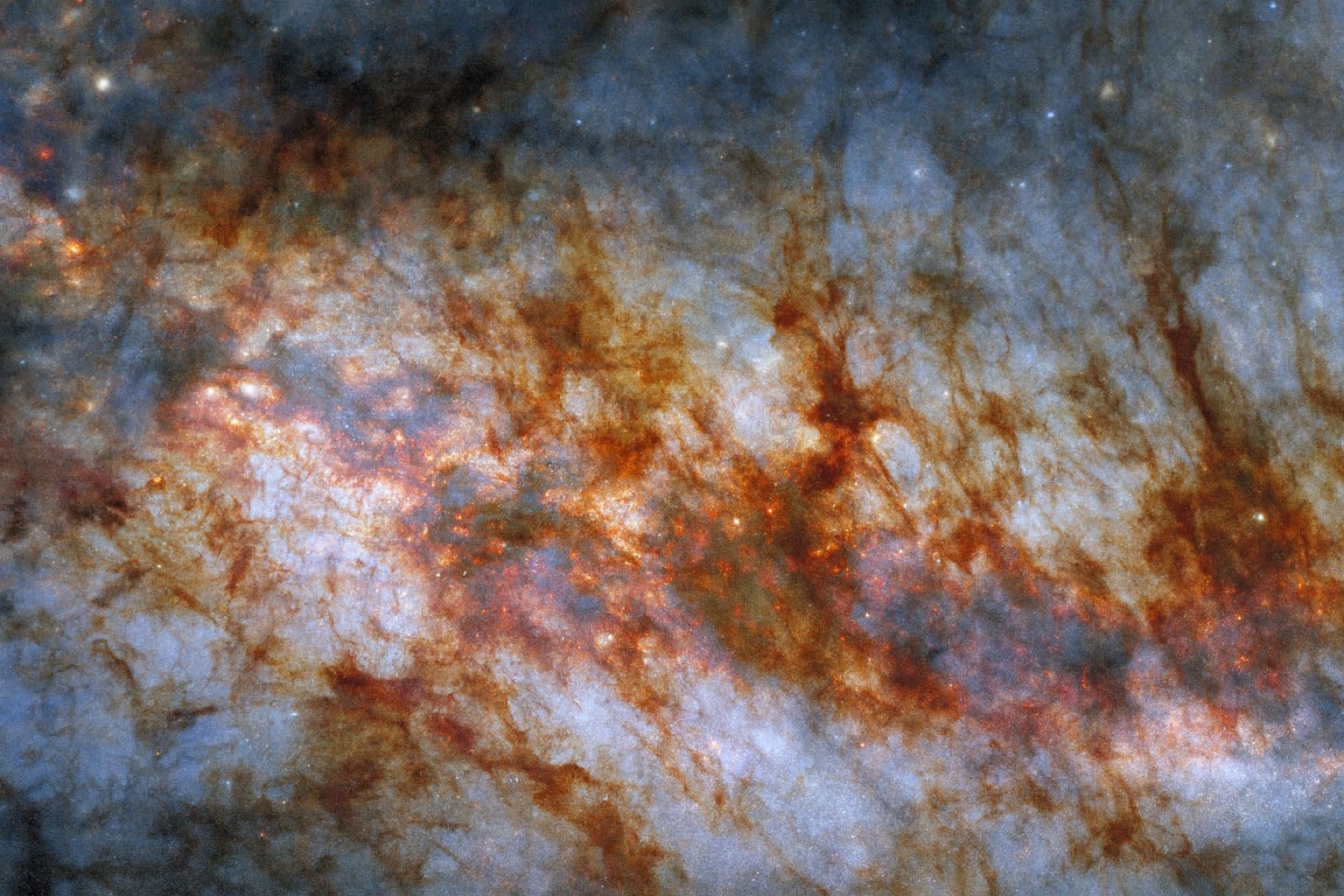

Hubble của NASA và ESA công bố hình ảnh ngoạn mục về lõi thiên hà Xì gà

Bức ảnh mới nhất từ Kính viễn vọng không gian Hubble của NASA và ESA vừa hé lộ những chi tiết chưa từng thấy về thiên hà Messier 82 (M82), nơi hàng triệu ngôi sao rực rỡ đang ẩn mình sau những đám mây bụi và khí với hình thù độc đáo. Bức ảnh mang […] - Thủ thuật

Premium

Lý do màn hình nhấp nháy khi chơi game và cách khắc phục

Hiện tượng màn hình nhấp nháy khi chơi game đã trở thành một nỗi ám ảnh đối với nhiều game thủ, gây khó chịu và ảnh hưởng đáng kể đến trải nghiệm. Theo các chuyên gia công nghệ, nguyên nhân chính của vấn đề này có thể nằm ở chính công nghệ đồng bộ hóa […] - Mobile

Premium

iPhone 17 Pro và iPhone Air vừa ra mắt đã dính lỗi trầy xước

Ngay khi vừa được bày bán tại các Apple Store trên toàn cầu, bộ đôi iPhone 17 Pro và iPhone Air – hai mẫu máy đang nhận được sự quan tâm đặc biệt của cộng đồng công nghệ – đã bắt đầu ghi nhận những phản ánh đầu tiên về hiện tượng trầy xước. Điều […] - Khám phá

Premium

Jimmy Kimmel bị đình chỉ: ‘Văn hóa tẩy chay’ hay áp lực chính trị?

Mới đây, đài truyền hình ABC, thuộc sở hữu của Disney, đã đột ngột đình chỉ chương trình nổi tiếng Jimmy Kimmel Live. Quyết định này được đưa ra ngay sau khi nam MC có một bình luận gây tranh cãi về vụ án mạng liên quan đến Charlie Kirk. Sự việc nhanh chóng trở […]

Bài viết liên quan

Premium

PremiumHubble của NASA và ESA công bố hình ảnh ngoạn mục về lõi thiên hà Xì gà

Premium

PremiumLý do màn hình nhấp nháy khi chơi game và cách khắc phục

Premium

PremiumiPhone 17 Pro và iPhone Air vừa ra mắt đã dính lỗi trầy xước

Premium

PremiumJimmy Kimmel bị đình chỉ: ‘Văn hóa tẩy chay’ hay áp lực chính trị?

Vũ khí mới của TikTok Shop trong cuộc chiến giành thị phần với Amazon

New York chính thức “tuyên chiến” với AI thiếu kiểm soát: Big Tech không thể lách luật?

Cẩn thận với Tạp Hóa MMO (taphoammo.net)

Pinterest bị sập toàn cầu, nghi vấn do sự cố từ Amazon Web Services

Thiết bị ‘siêu máy tính AI’ cá nhân của Nvidia sẵn sàng ra mắt thị trường vào 15/10

California thiết lập khung pháp lý cho các ứng dụng chatbot AI

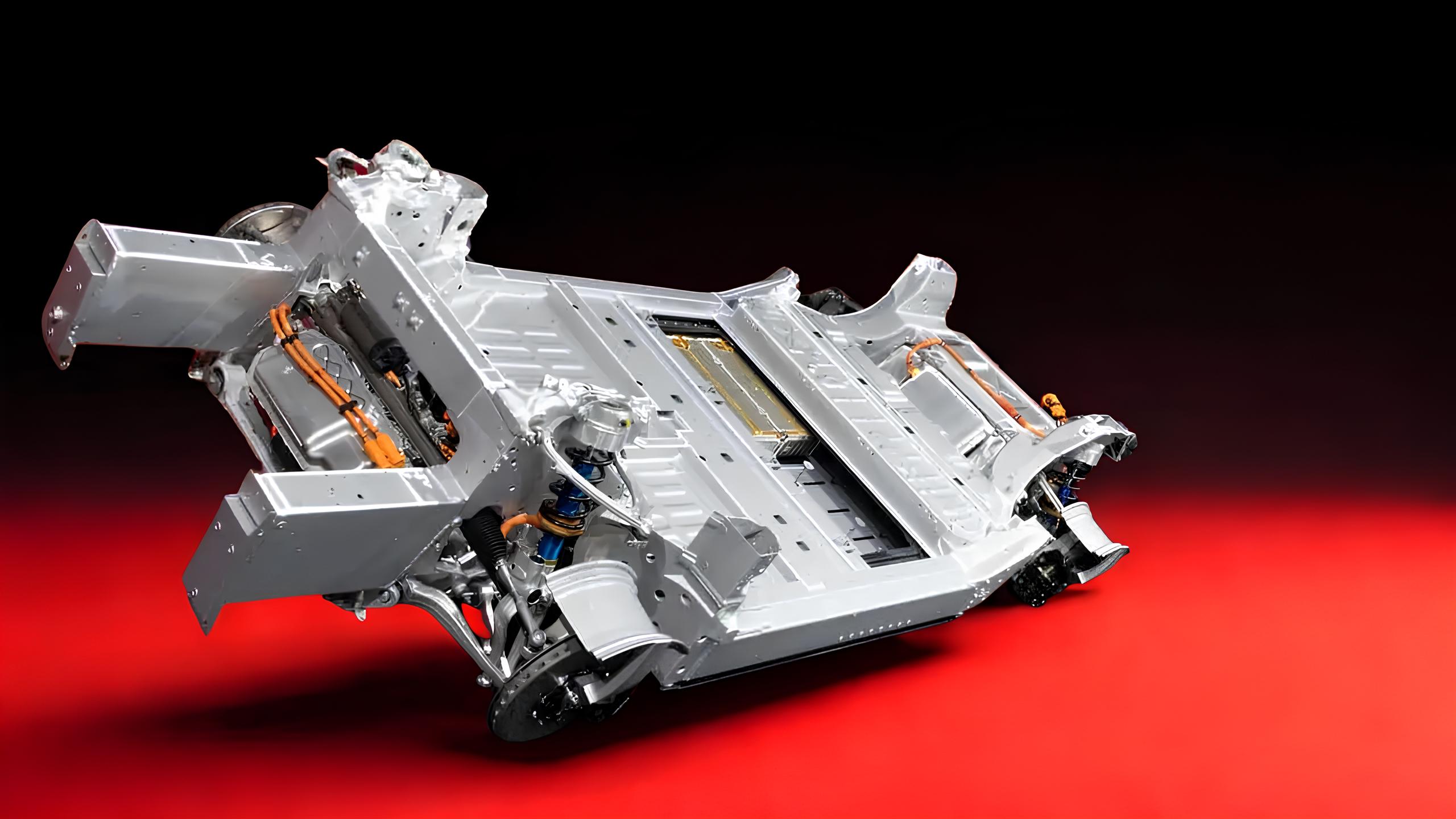

Ferrari hé lộ thông tin chi tiết về mẫu xe điện đầu tiên, hứa hẹn hiệu suất vượt trội

Fan hâm mộ Taylor Swift phản ứng trước nghi vấn cô dùng hình ảnh tạo bởi AI trong chiến dịch quảng bá

Doanh số ‘khủng’ của Tesla liệu có đủ trấn an nỗi lo về sự ảm đạm của ngành xe điện toàn cầu?

Nội bộ OpenAI đang đối mặt với những thách thức từ chiến lược truyền thông xã hội mới của công ty

Toyota bổ sung khoản vốn 1,5 tỷ USD, khẳng định niềm tin vào các dự án startup công nghệ

OpenAI công bố mô hình Sora 2 và ứng dụng chia sẻ video, mục tiêu cạnh tranh với Tiktok

Thông tin sai lệch của nền tảng Deepseek AI về chủ quyền biển đảo Việt Nam gây tranh cãi

DeepSeek: Từ A đến Z về ứng dụng trò chuyện AI được giới công nghệ quan tâm

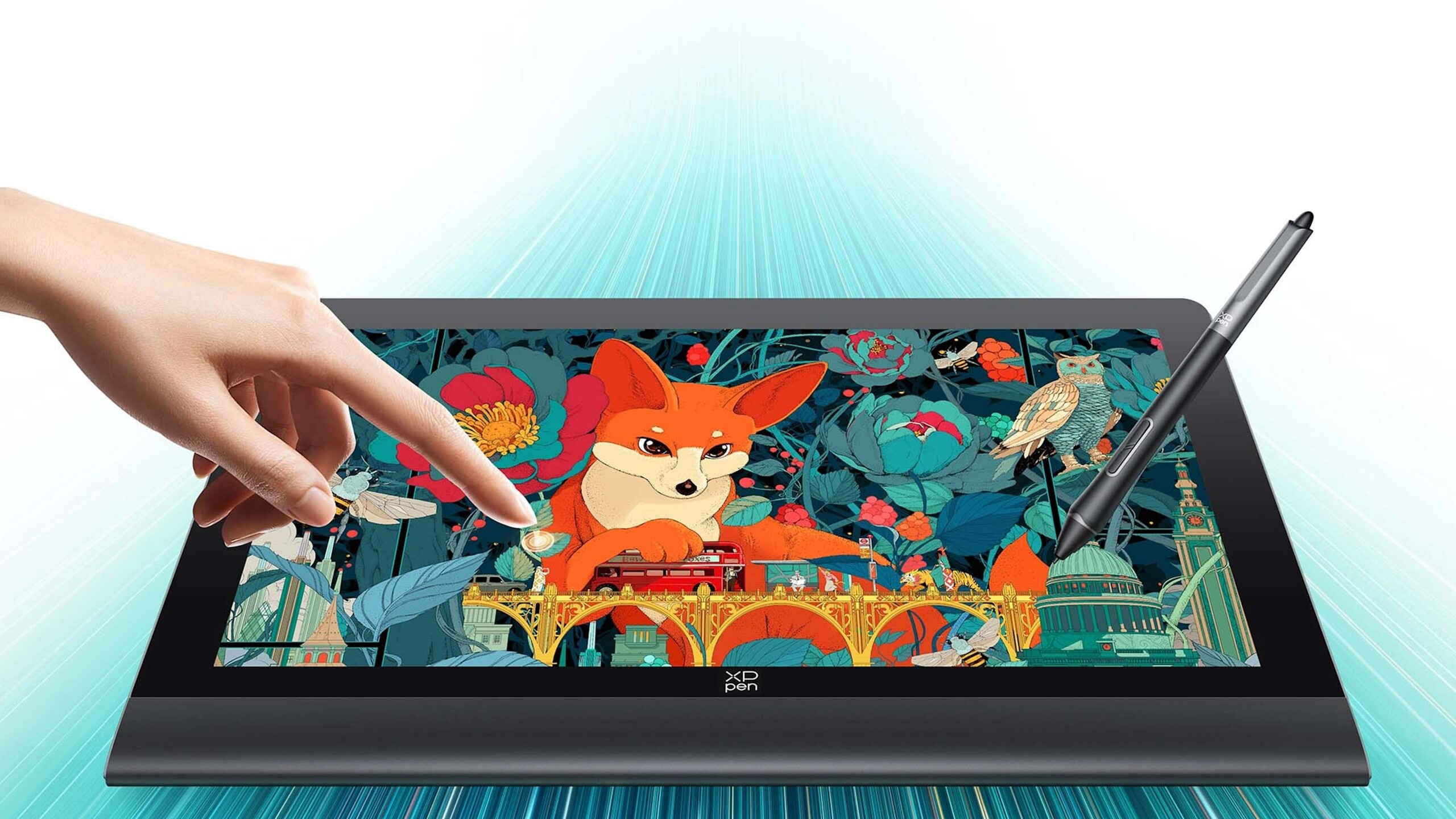

XP-Pen Artist Ultra 16: Bảng vẽ 4K AMOLED cho dân thiết kế chuyên nghiệp

ĐĂNG KÝ NHẬN TIN

NGAY HÔM NAY

Đăng ký để nhận thông tin sớm nhất về những câu chuyện nóng hổi hiện nay trên thị trường, công nghệ được cung cấp hàng ngày.

Bằng cách nhấp vào “Đăng ký”, bạn chấp nhận Điều khoản dịch vụ và Chính sách quyền riêng tư của chúng tôi. Bạn có thể chọn không tham gia bất cứ lúc nào.

Nhận xét (0)