Vietnam has regulations on cryptocurrency for the first time

14:40 23/05/2024

2 phút đọc

Decree 52 on non-cash payments, effective from July 1, 2024, has officially defined electronic money for the first time in Vietnam. Accordingly, cryptocurrency is the value of coins stored on electronic devices such as e-wallets and prepaid cards, based on the amount of money the customer has pre-loaded to the bank or e-wallet service provider. .

Two popular means of storing cryptocurrency are:

- E-wallet: Service that provides customers with an identifiable electronic account to make payment transactions. E-wallets can be integrated on smartphones, computers or other electronic devices.

- Prepaid card: A card that allows the cardholder to make payments within the pre-loaded value.

Decree 52 also stipulates a number of new points on non-cash payments, including:

- Organizations providing e-wallet services must ensure there is enough balance to pay for all issued e-wallets.

- The e-wallet must be linked to the customer’s payment account or debit card.

- The State Bank will be responsible for state management of non-cash payment activities, including electronic money.

According to information from the State Bank, currently in Vietnam there are more than 40 e-wallet providers operating in parallel with banks in the payment field. The number of e-wallets in use reached 36 million as of the end of last year, according to data reported by FiinGroup.

Thus, it can be seen that the Vietnamese payment market is extremely vibrant with the participation of many e-wallets. This gives users more convenient, safe and economical payment options.

In addition, Vietnam has not yet built a legal framework for digital currencies and virtual assets, however, Bitcoin and other virtual currencies are not considered electronic money and are not allowed to perform the functions of fiat currencies. in Viet Nam.

Overall, Decree 52 has marked an important step forward in perfecting the legal framework for the non-cash payment sector in Vietnam. Defining electronic money and promulgating new regulations on non-cash payments will help ensure safety, efficiency and transparency for payment activities, contributing to promoting digital economic development.

Từ khoá:

Bài viết liên quan

Palm Mini 2 Ultra: Máy tính bảng mini cho game thủ

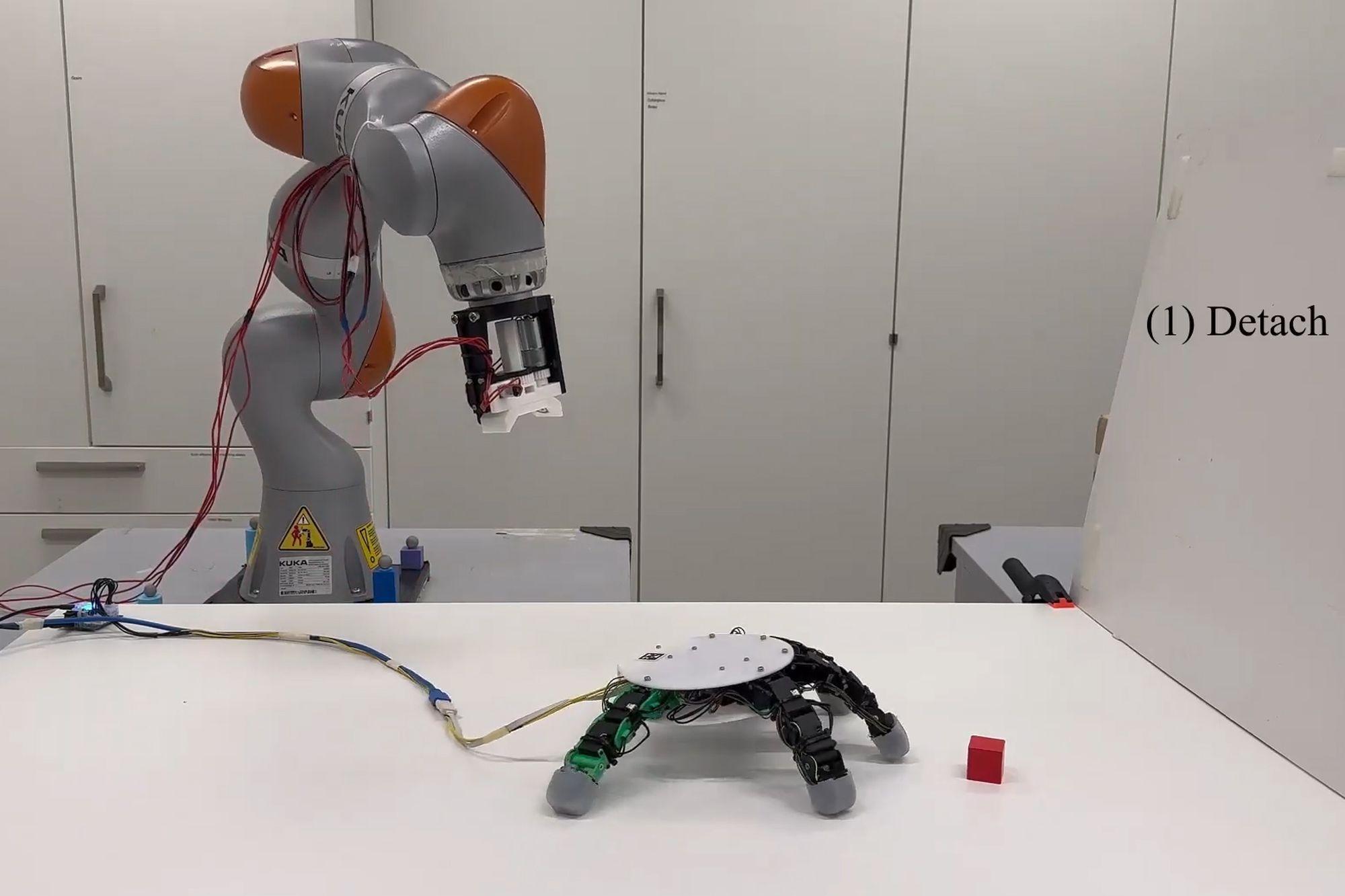

Robot with smart grip

NASA’s goal of conquering the Sun

Apple launches a new feature that makes it easier to use your phone while sitting on vehicle

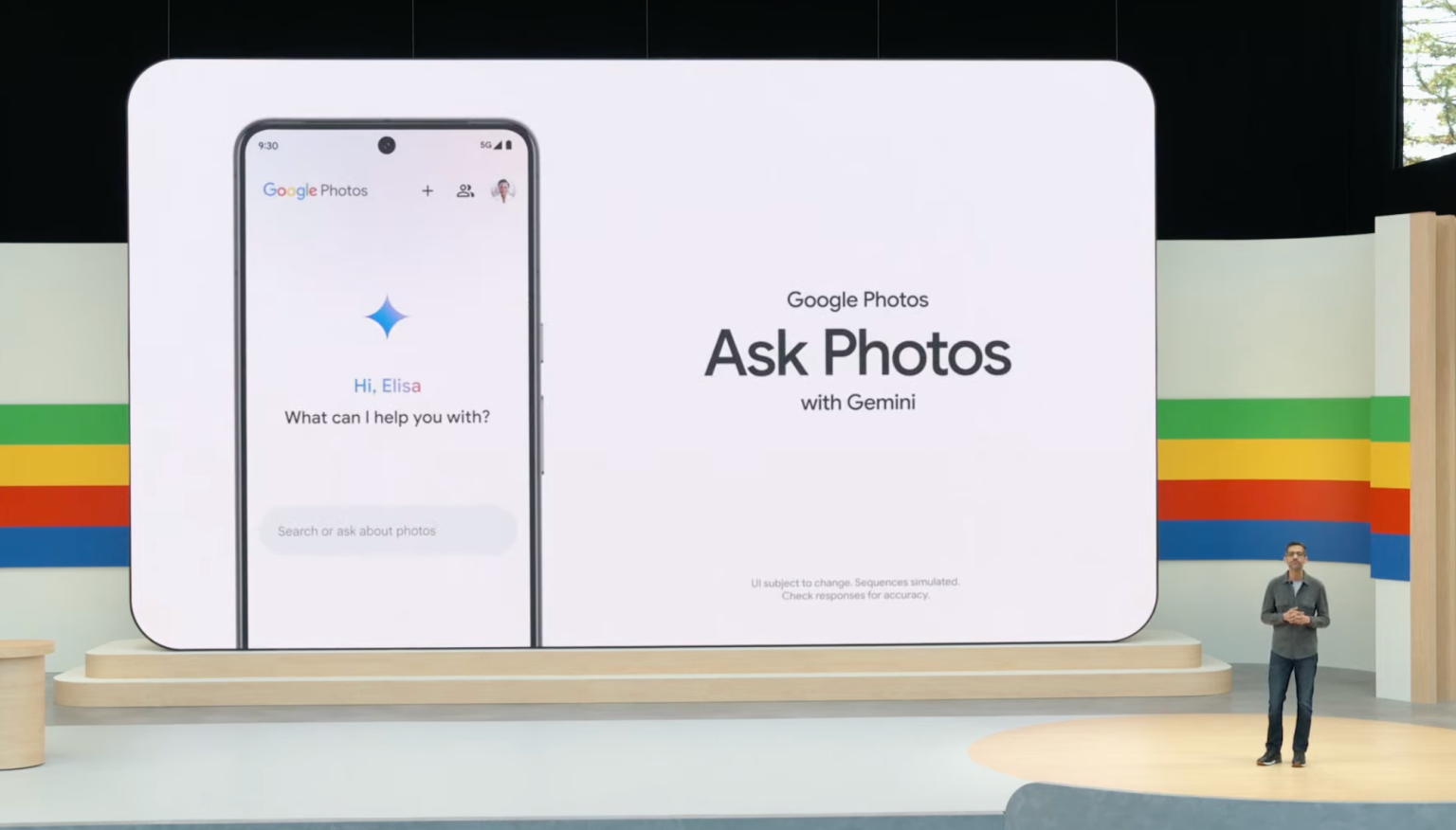

Google Photos launches smart search feature “Ask for photos”

Roku streams live MLB baseball games for free

Gun detection AI technology company uses Disney to successfully persuade New York

Hackers claim to have collected 49 million Dell customer addresses before the company discovered the breach

Thai food delivery app Line Man Wongnai plans to IPO in Thailand and the US in 2025

Google pioneered the development of the first social networking application for Android

AI outperforms humans in gaming: Altera receives investment from Eric Schmidt

TikTok automatically labels AI content from platforms like DALL·E 3

Dell’s data was hacked, revealing customers’ home address information

Cracking passwords using Brute Force takes more time, but don’t rejoice!

US lawsuit against Apple: What will happen to iPhone and Android?

The UAE will likely help fund OpenAI’s self-produced chips

AI-composed blues music lacks human flair and rhythm

iOS 17: iPhone is safer with anti-theft feature

Samsung launches 2024 OLED TV with the highlight of breakthrough anti-glare technology

REGISTER

TODAY

Sign up to get the inside scoop on today's biggest stories in markets, technology delivered daily.

By clicking “Sign Up”, you accept our Terms of Service and Privacy Policy. You can opt out at any time.

Nhận xét (0)