Venture capital fund “turn the wheel”: Support rival startups instead of just focusing on profits

15:22 27/05/2024

2 phút đọc

Uncork Capital , one of the preeminent seed-stage venture capital funds in the San Francisco Bay area, celebrated its 20th anniversary. The ceremony took place at a renovated church in the SoMa area of San Francisco, with the participation of 420 guests.

Attendees reviewed the ups and downs of the venture capital industry, shared experiences, and discussed the significant changes the field has seen since Uncork Capital was born.

Increase in scale: When establishing the fund, founder Jeff Clavier mainly used his savings to invest in startups with an amount of about several hundred thousand US dollars. Today, Clavier and colleagues like Josh Kopelman of First Round Capital and Aydin Senkut of Felicis manage billions of dollars in assets. The entire venture capital industry also grew dramatically. In 2004, venture capital funds poured about 20 billion USD into startups. By 2021, this number has reached 350 billion USD.

Changes in the way of operations: Along with the growth of industry scale, many operating rules also change. Uncork Capital founder Jeff Clavier and Andy McLoughlin, the fund’s managing partner, discussed some of these changes.

- Investors participate in individual investments: Previously, organizations sponsoring venture capital funds often required partners to only focus on investing in the fund. Nowadays, it is more accepted for investors to personally invest in startups, as long as they do not compete with fund investments.

- Investing in competing companies: Although investing in directly competing companies remains controversial, it is more accepted than it used to be. However, both Clavier and McLoughlin believe that this is not recommended because it can cause information leakage and affect invested startups.

- Role of board members: The role of board members appointed by venture capital funds used to be a way to confirm the value of the investment. However, some venture investors believe this is not necessary. Clavier believes that it is the responsibility of investors to support startups. On the other hand, McLoughlin believes that the role of board members will change depending on the company’s stage of development.

Current market challenges: The market is having difficulty withdrawing capital from investments. This forces venture capitalists to stay on the startup’s board longer, limiting their ability to join other companies. In addition, the boom in early-stage investment funds in recent years may decline due to limited capital resources.

Comment on artificial intelligence (AI): Both Clavier and McLoughlin believe that the AI market is overvalued. They believe it is important to invest in AI businesses that are sustainable and profitable over the long term.

Overall, although the venture capital industry has changed a lot, the basic principles of investing in promising businesses remain the same.

Từ khoá:

Bài viết liên quan

Palm Mini 2 Ultra: Máy tính bảng mini cho game thủ

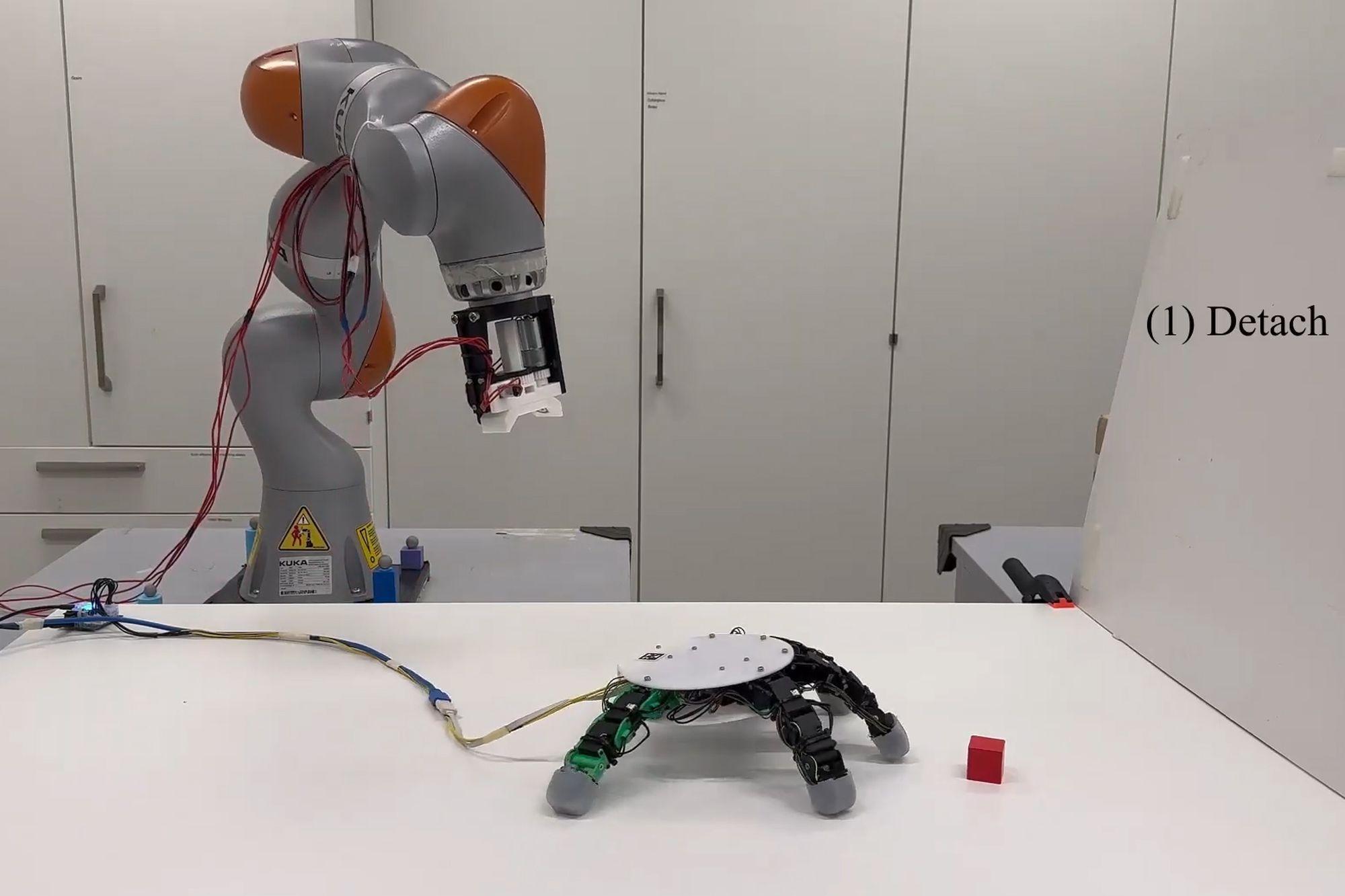

Robot with smart grip

NASA’s goal of conquering the Sun

Apple launches a new feature that makes it easier to use your phone while sitting on vehicle

Google Photos launches smart search feature “Ask for photos”

Roku streams live MLB baseball games for free

Gun detection AI technology company uses Disney to successfully persuade New York

Hackers claim to have collected 49 million Dell customer addresses before the company discovered the breach

Thai food delivery app Line Man Wongnai plans to IPO in Thailand and the US in 2025

Google pioneered the development of the first social networking application for Android

AI outperforms humans in gaming: Altera receives investment from Eric Schmidt

TikTok automatically labels AI content from platforms like DALL·E 3

Dell’s data was hacked, revealing customers’ home address information

Cracking passwords using Brute Force takes more time, but don’t rejoice!

US lawsuit against Apple: What will happen to iPhone and Android?

The UAE will likely help fund OpenAI’s self-produced chips

AI-composed blues music lacks human flair and rhythm

iOS 17: iPhone is safer with anti-theft feature

Samsung launches 2024 OLED TV with the highlight of breakthrough anti-glare technology

REGISTER

TODAY

Sign up to get the inside scoop on today's biggest stories in markets, technology delivered daily.

By clicking “Sign Up”, you accept our Terms of Service and Privacy Policy. You can opt out at any time.

Nhận xét (0)