Synapse collapses, 10 million users at risk

09:50 26/05/2024

2 phút đọc

The financial technology (Fintech) startup market, which boomed in 2021, is now facing many difficulties, especially in providing banking services to third parties (Banking-as-a-Service, BaaS). .

The most notable event was the BaaS company Synapse declaring bankruptcy. This incident shows the fragility of the Fintech ecosystem when an important link has problems.

Synapse provides a service that allows other companies (mainly Fintechs) to integrate banking services into their products. For example, a company specializing in payroll for independent contractors used Synapse to provide instant payments.

Synapse was once considered a bright area of Fintech, raising more than $50 million from venture capital funds. However, by 2023, the company encountered difficulties, had to cut staff and filed for chapter 11 bankruptcy in April this year.

Plans to sell the assets to another Fintech company for $9.7 million also failed. As a result, Synapse is at risk of having to completely dissolve under chapter 7, affecting many other startups and customers.

For example, children’s banking startup Copper had to stop issuing accounts and debit cards due to its reliance on Synapse. This left many customers, mainly families, unable to access their funds.

Additionally, cryptocurrency app Juno and lending company Mainvest were also affected. According to estimates, about 100 Fintech companies and 10 million customers could ultimately be impacted by Synapse’s collapse.

https://mainvest.notion.site/Investor-Support-Hub-45c61ca735dd4daf8203c28d8945f9ff#3d543d9dcdf94df2b5dd6cacca0e16e3

This case shows the need for regulatory compliance and transparent operations in the Fintech sector. Banks also need to be more careful when choosing BaaS partners.

In addition, regulators need to have clearer regulations on consumer protection in the field of digital banking.

The collapse of Synapse may make banks (traditional and Fintech) more cautious about partnering with BaaS providers.

Fintech is a field that requires strict compliance with regulations. When companies take risks in a hurry, the ultimate losers are the users.

Massive investments in 2020 and 2021 caused many Fintech companies to grow rapidly to satisfy investors, despite regulatory compliance. The lesson learned from Synapse’s event is that Fintech needs to develop sustainably and comply with regulations. This incident may affect the ability of Fintech companies to raise capital in the future.

Bài viết liên quan

Palm Mini 2 Ultra: Máy tính bảng mini cho game thủ

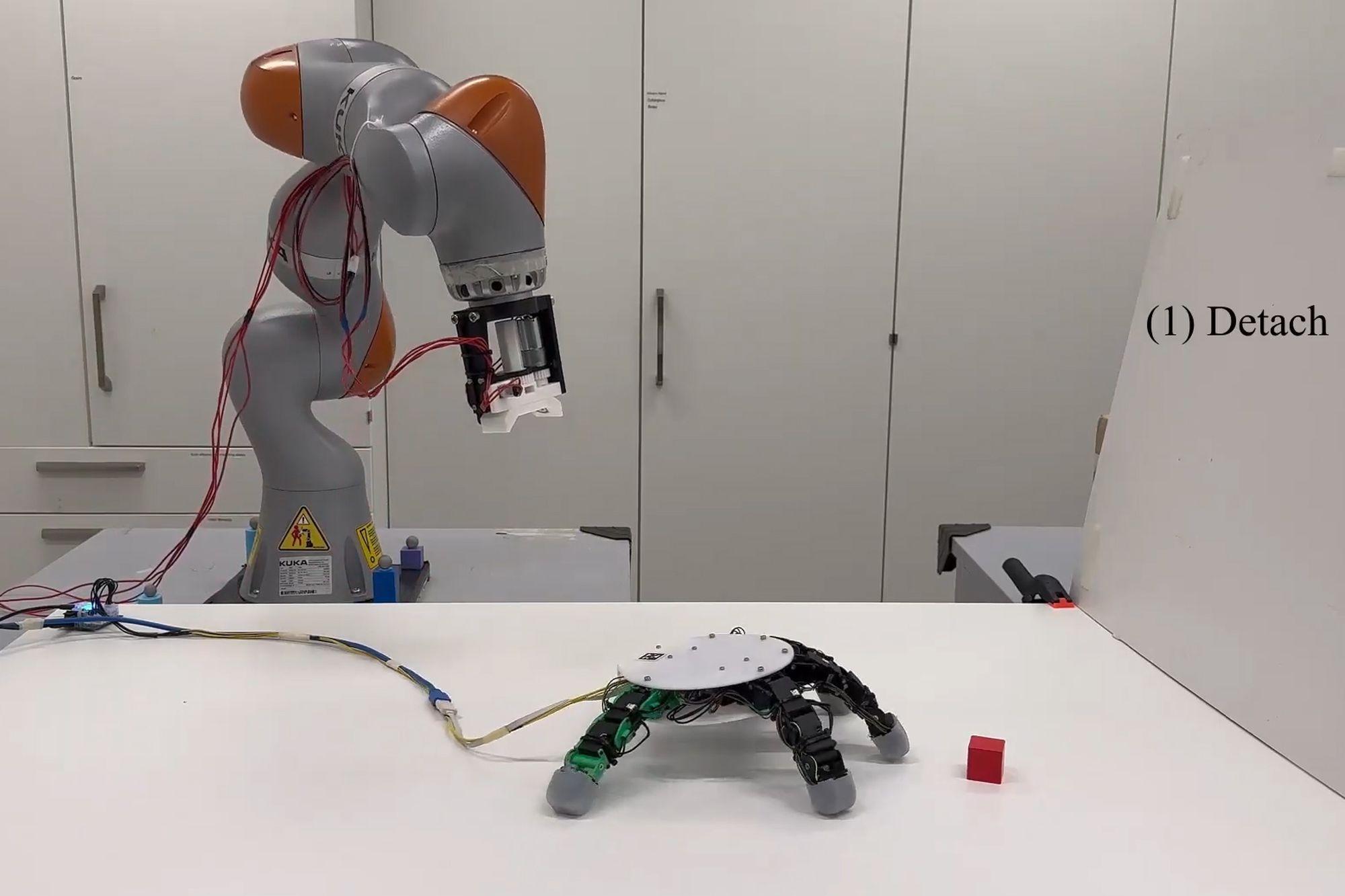

Robot with smart grip

NASA’s goal of conquering the Sun

Apple launches a new feature that makes it easier to use your phone while sitting on vehicle

Google Photos launches smart search feature “Ask for photos”

Roku streams live MLB baseball games for free

Gun detection AI technology company uses Disney to successfully persuade New York

Hackers claim to have collected 49 million Dell customer addresses before the company discovered the breach

Thai food delivery app Line Man Wongnai plans to IPO in Thailand and the US in 2025

Google pioneered the development of the first social networking application for Android

AI outperforms humans in gaming: Altera receives investment from Eric Schmidt

TikTok automatically labels AI content from platforms like DALL·E 3

Dell’s data was hacked, revealing customers’ home address information

Cracking passwords using Brute Force takes more time, but don’t rejoice!

US lawsuit against Apple: What will happen to iPhone and Android?

The UAE will likely help fund OpenAI’s self-produced chips

AI-composed blues music lacks human flair and rhythm

iOS 17: iPhone is safer with anti-theft feature

Samsung launches 2024 OLED TV with the highlight of breakthrough anti-glare technology

REGISTER

TODAY

Sign up to get the inside scoop on today's biggest stories in markets, technology delivered daily.

By clicking “Sign Up”, you accept our Terms of Service and Privacy Policy. You can opt out at any time.

Nhận xét (0)