Nvidia shares hit a new peak after forecasts showed strong demand for AI chips

10:24 27/05/2024

2 phút đọc

Nvidia caused a stir in the tech market when its stock price jumped more than 9% on Thursday after reporting profits that beat Wall Street forecasts. This shows that demand for its artificial intelligence (AI) chips remains extremely strong. The company’s data center revenue increased by 427% last quarter.

Nvidia stock price surpassed the $1,000 mark for the first time, reaching a high of $1,037.99. Their previous peak was $953.86 set on May 21.

Nvidia’s first-quarter revenue reached $26.04 billion, higher than LSEG’s estimate of $24.65 billion. And this need remains unabated.

The company issued strong guidance, projecting revenue of $28 billion in the current quarter, surpassing LSEG’s estimate of $26.61 billion.

Despite some analysts’ concerns about a temporary slowdown, others were even more bullish on Nvidia following its results. Bernstein’s Stacy Rasgon raised the company’s price target to $1,300, writing in a note to investors that the story surrounding the company “is clearly not over, or likely to have peaked yet.” point.” He added that Nvidia’s stock appears to be undervalued.

Jefferies also raised its price target on Nvidia stock to $1,350 due to the strong performance of its new AI graphics processor called Blackwell and predicted an acceleration to “outperformance” by the end of the year. now when this platform launches.

Nvidia’s net profit reached $14.88 billion, equivalent to $5.98 per share, up sharply from $2.04 billion, equivalent to 82 cents per share, in the same period last year.

On Wednesday, Nvidia announced a 10-1 stock split, with shares starting to trade adjusted for the split at the opening session on June 10.

Từ khoá:

Bài viết liên quan

Palm Mini 2 Ultra: Máy tính bảng mini cho game thủ

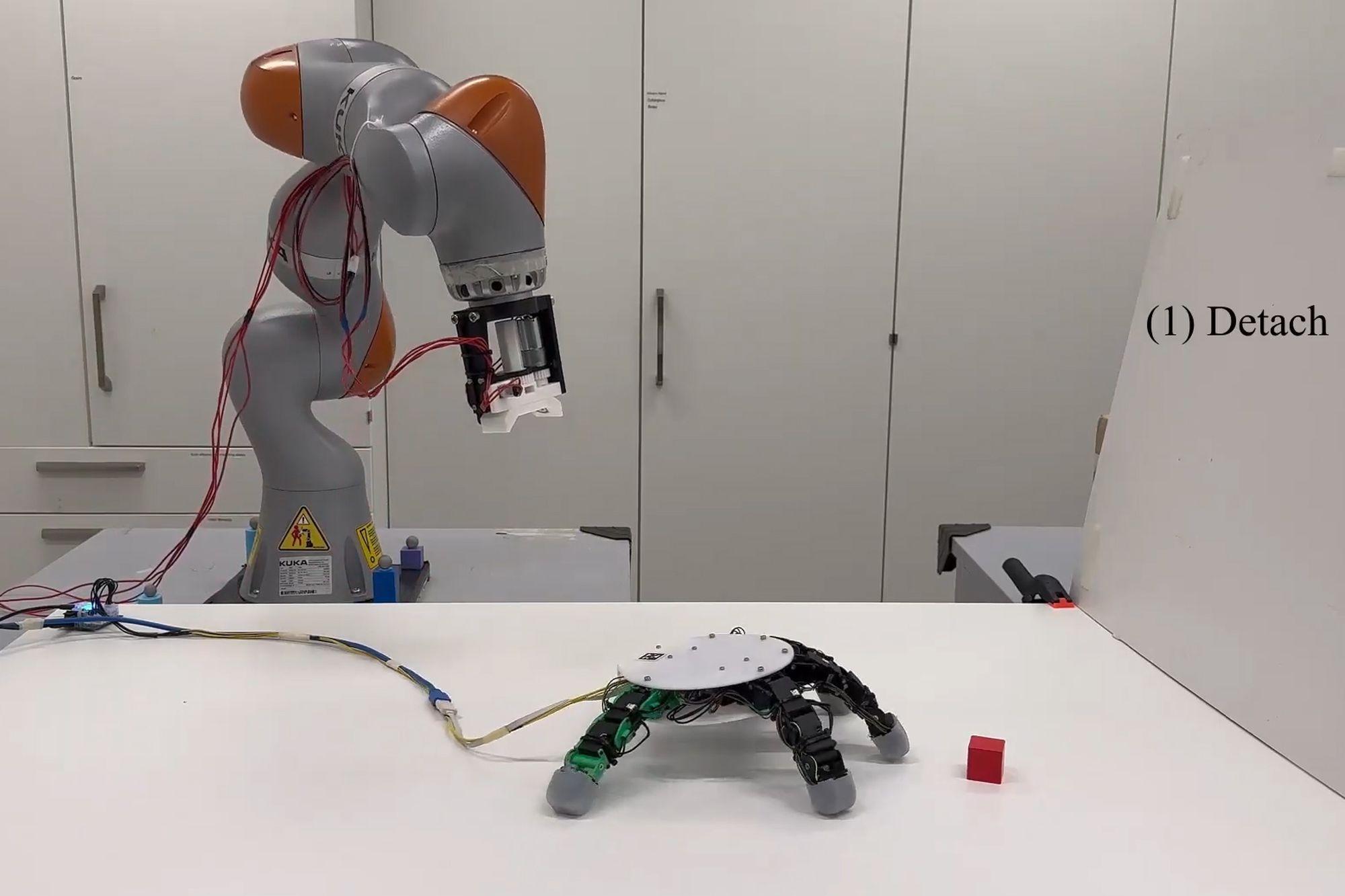

Robot with smart grip

NASA’s goal of conquering the Sun

Apple launches a new feature that makes it easier to use your phone while sitting on vehicle

Google Photos launches smart search feature “Ask for photos”

Roku streams live MLB baseball games for free

Gun detection AI technology company uses Disney to successfully persuade New York

Hackers claim to have collected 49 million Dell customer addresses before the company discovered the breach

Thai food delivery app Line Man Wongnai plans to IPO in Thailand and the US in 2025

Google pioneered the development of the first social networking application for Android

AI outperforms humans in gaming: Altera receives investment from Eric Schmidt

TikTok automatically labels AI content from platforms like DALL·E 3

Dell’s data was hacked, revealing customers’ home address information

Cracking passwords using Brute Force takes more time, but don’t rejoice!

US lawsuit against Apple: What will happen to iPhone and Android?

The UAE will likely help fund OpenAI’s self-produced chips

AI-composed blues music lacks human flair and rhythm

iOS 17: iPhone is safer with anti-theft feature

Samsung launches 2024 OLED TV with the highlight of breakthrough anti-glare technology

REGISTER

TODAY

Sign up to get the inside scoop on today's biggest stories in markets, technology delivered daily.

By clicking “Sign Up”, you accept our Terms of Service and Privacy Policy. You can opt out at any time.

Nhận xét (0)