Go Digit, an Indian insurance startup, raised $141 million before its IPO

14:09 15/05/2024

2 phút đọc

Indian online insurance company Go Digit has raised $141 million from investors ahead of its initial public offering (IPO) on Wednesday.

Large investors participating in Go Digit ‘s pre-IPO mobilization round include familiar names such as Fidelity, Goldman Sachs, Morgan Stanley, or investment funds from Abu Dhabi, Singapore, Korea… Besides, major Indian domestic mutual funds managed by SBI, ICICI, Axis, Tata and Edelweiss also participated in support.

Founded by Kamesh Goyal, a former KPMG executive and seasoned insurance industry veteran, Go Digit offers auto, health, travel and accident insurance products. Go Digit’s strength is its simple insurance purchasing and settlement process, allowing users to self-check, submit claims and track services right on their smartphones. According to the IPO filing, by the end of December last year, Go Digit had about 43 million customers and issued a total of 8 million insurance contracts.

This Mumbai-based startup aims to raise about $313 million from the IPO. Go Digit is aiming for a valuation of about $3 billion, down 25% from its previous valuation of $4 billion.

Individual investors in India are increasingly interested in technology startups. Although the country’s Sensex index has only increased 1.4% this year, many technology startups listed on the Indian stock exchange in recent years have had outstanding achievements. Shares of food delivery company Zomato are up 51.2% this year, while shares of insurance aggregator PolicyBazaar are up 60.4%.

Go Digit, backed by investment funds such as Peak unfavorable. According to the IPO draft documents submitted previously, Go Digit plans to raise 440 million USD.

Go Digit is just one of many Indian companies looking to go public this year. Last month, food delivery startup Swiggy also filed for an IPO with the goal of raising about 1.25 billion USD. Ola Electric filed for an IPO late last year, and its parent company, ride-hailing giant Ola, has similar plans this year.

Từ khoá:

Bài viết liên quan

Palm Mini 2 Ultra: Máy tính bảng mini cho game thủ

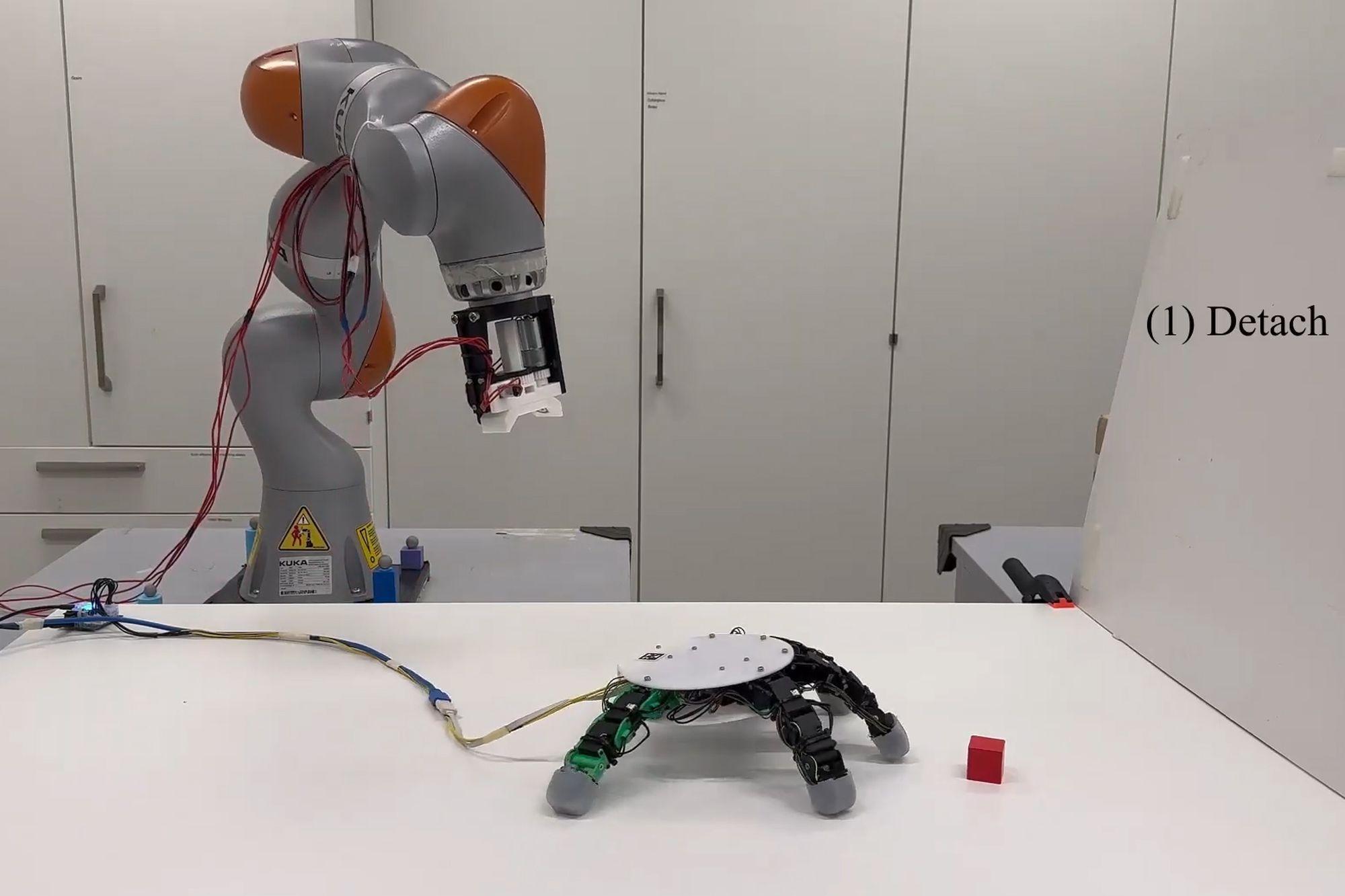

Robot with smart grip

NASA’s goal of conquering the Sun

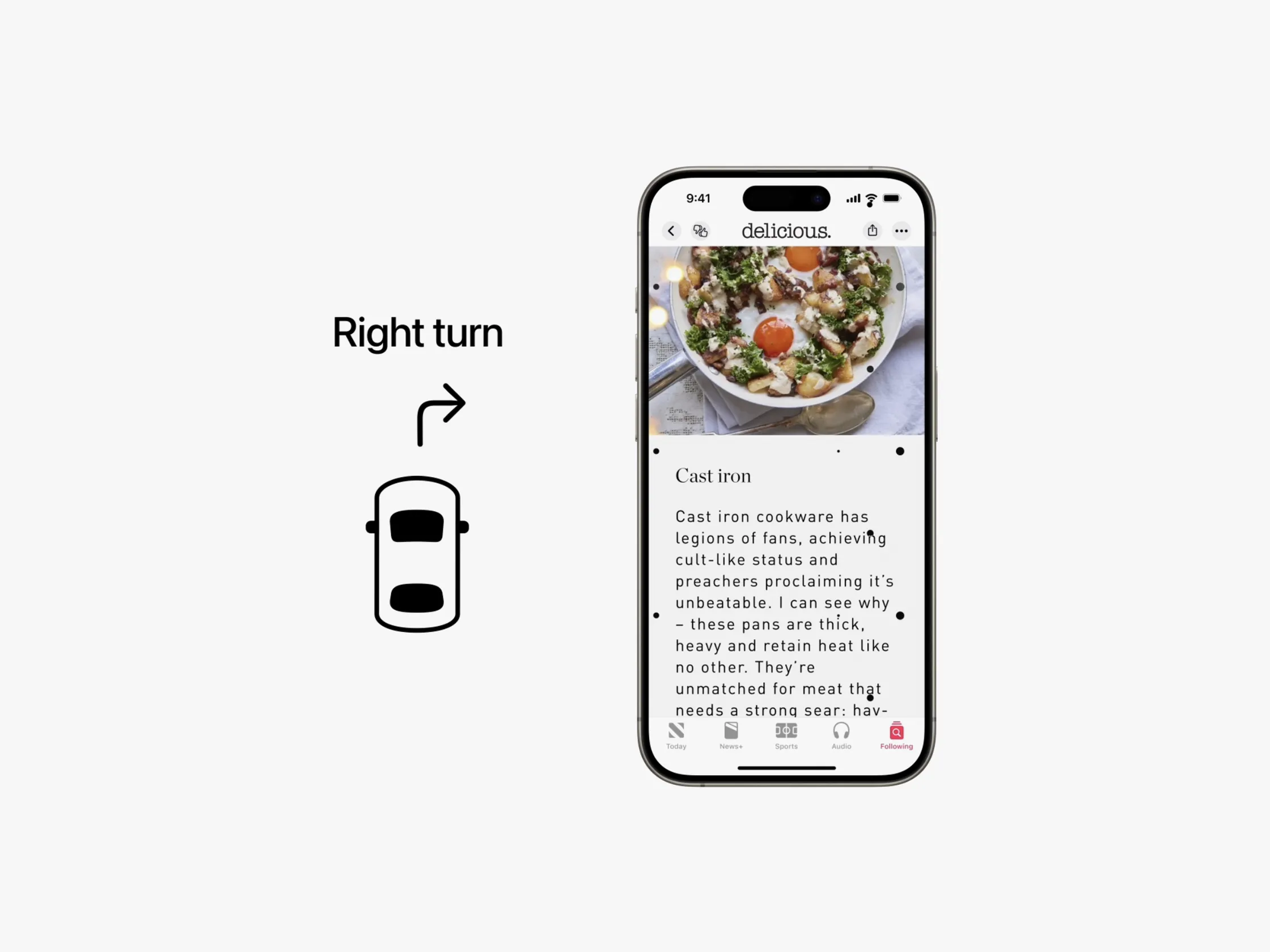

Apple launches a new feature that makes it easier to use your phone while sitting on vehicle

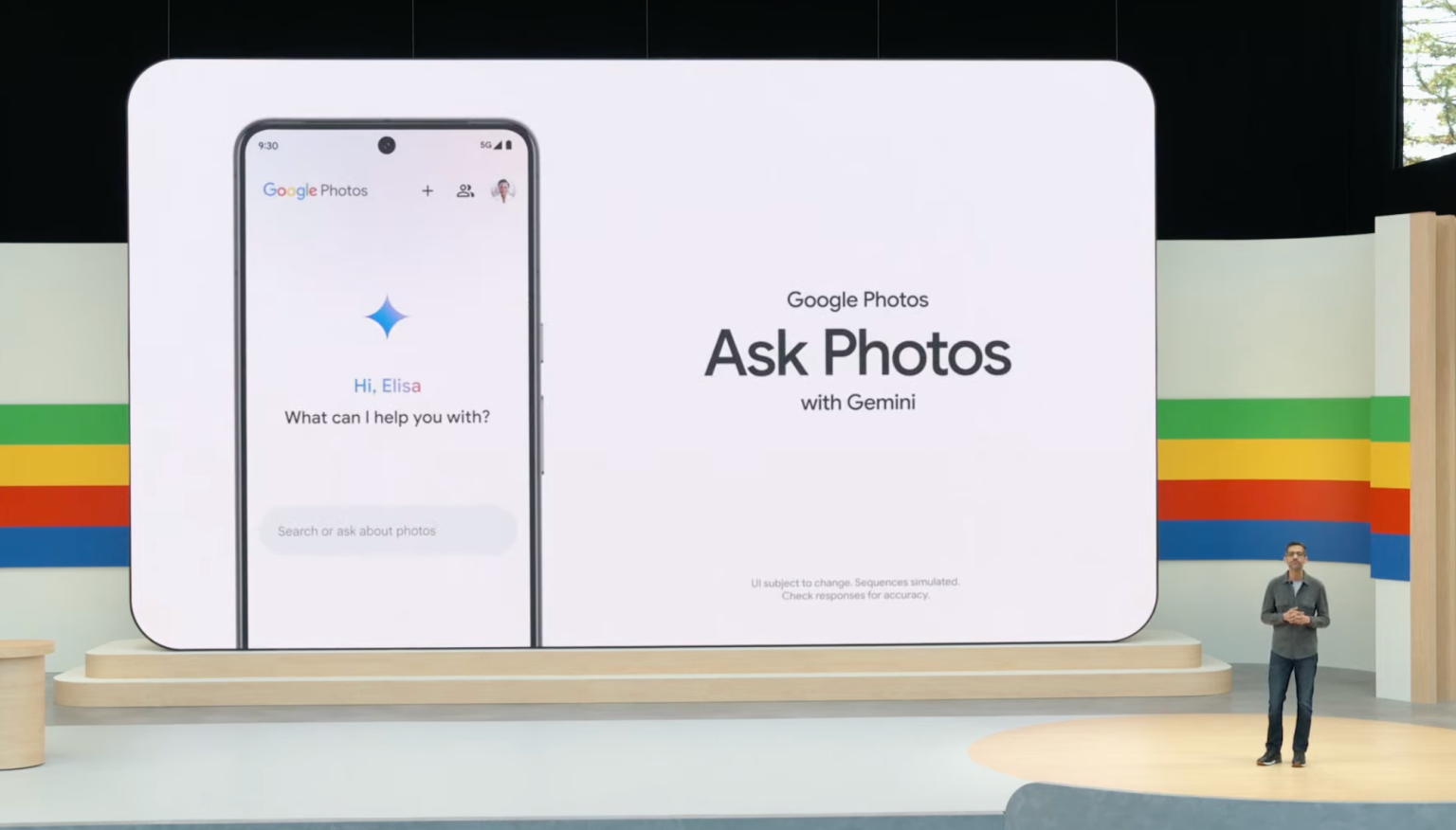

Google Photos launches smart search feature “Ask for photos”

Roku streams live MLB baseball games for free

Gun detection AI technology company uses Disney to successfully persuade New York

Hackers claim to have collected 49 million Dell customer addresses before the company discovered the breach

Thai food delivery app Line Man Wongnai plans to IPO in Thailand and the US in 2025

Google pioneered the development of the first social networking application for Android

AI outperforms humans in gaming: Altera receives investment from Eric Schmidt

TikTok automatically labels AI content from platforms like DALL·E 3

Dell’s data was hacked, revealing customers’ home address information

Cracking passwords using Brute Force takes more time, but don’t rejoice!

US lawsuit against Apple: What will happen to iPhone and Android?

The UAE will likely help fund OpenAI’s self-produced chips

AI-composed blues music lacks human flair and rhythm

iOS 17: iPhone is safer with anti-theft feature

Samsung launches 2024 OLED TV with the highlight of breakthrough anti-glare technology

REGISTER

TODAY

Sign up to get the inside scoop on today's biggest stories in markets, technology delivered daily.

By clicking “Sign Up”, you accept our Terms of Service and Privacy Policy. You can opt out at any time.

Nhận xét (0)