Cloover provides financial support to solar power installers, promoting the adoption of renewable energy

16:57 28/05/2024

2 phút đọc

Previously, electricity prices skyrocketed due to the war situation in Europe, causing increased demand for solar panel installation. However, electricity prices have now dropped and solar panel installers are having to spend more on marketing to attract customers.

One of the effective ways to win more customers is to provide financial solutions. But small installation companies often do not have enough resources to self-guarantee new installation projects, which can cost up to tens of thousands of euros each, forcing customers to borrow from banks themselves.

The problem is that many customers switch to another provider “because on the way to the bank, they get contacted by five other providers,” Jodok Betschart, co-founder and co-CEO of Cloover, told TechCrunch.

For Betschart and its co-founders, Peder Broms and Valentin Gönczy, the answer lies not only in better project bidding software, but also in adding financing solutions to help small installers provide loans. “In just one conversation, installers can receive real-time credit and underwriting decisions,” Betschart said.

Their startup, Europe-based Cloover, has developed software that collects customer data to assess not only their ability to repay loans but also their energy spending. In many cases, the monthly payment for solar panels will be less than what someone pays on their electric bill.

“But banks really don’t integrate these energy savings into their models,” Betschart said. “Many times, we can authorize loans when a conventional bank says they can’t do that.”

To underwrite those loans, Cloover recently raised $108.5 million in debt along with a $5.5 million seed round led by Lowercarbon Capital with participation from 9900 Capital and QED’s Fontes. The startup will own these loans in a special vehicle funded through senior debt providers and will cover a small portion of them through equity, Betschart said.

The company charges installers a transaction fee for each loan they originate and also takes a percentage of each loan payment. When Cloover launches software later this year to allow homeowners to use battery backup to sell electricity to the grid, they will also get a cut of the profits.

Cloover will use the funding to hire sales and customer service teams to train installers on how to finance energy upgrades, Betschart said. Currently, the company is working with about 200 installers, although he added that there are thousands more installers who could use its services.

Giving small installers access to financing solutions will help accelerate the adoption of climate-friendly technologies, Betschart said.

“85% of all renewable energy installations of solar energy storage systems, heat pumps, energy management systems, etc., are done through local installers and SMB,” he said. Large companies already have sophisticated platforms to assess customers’ financial capabilities. “The only way to achieve the energy transition is by providing exactly the same options to SMB installers.”

Từ khoá:

Bài viết liên quan

Palm Mini 2 Ultra: Máy tính bảng mini cho game thủ

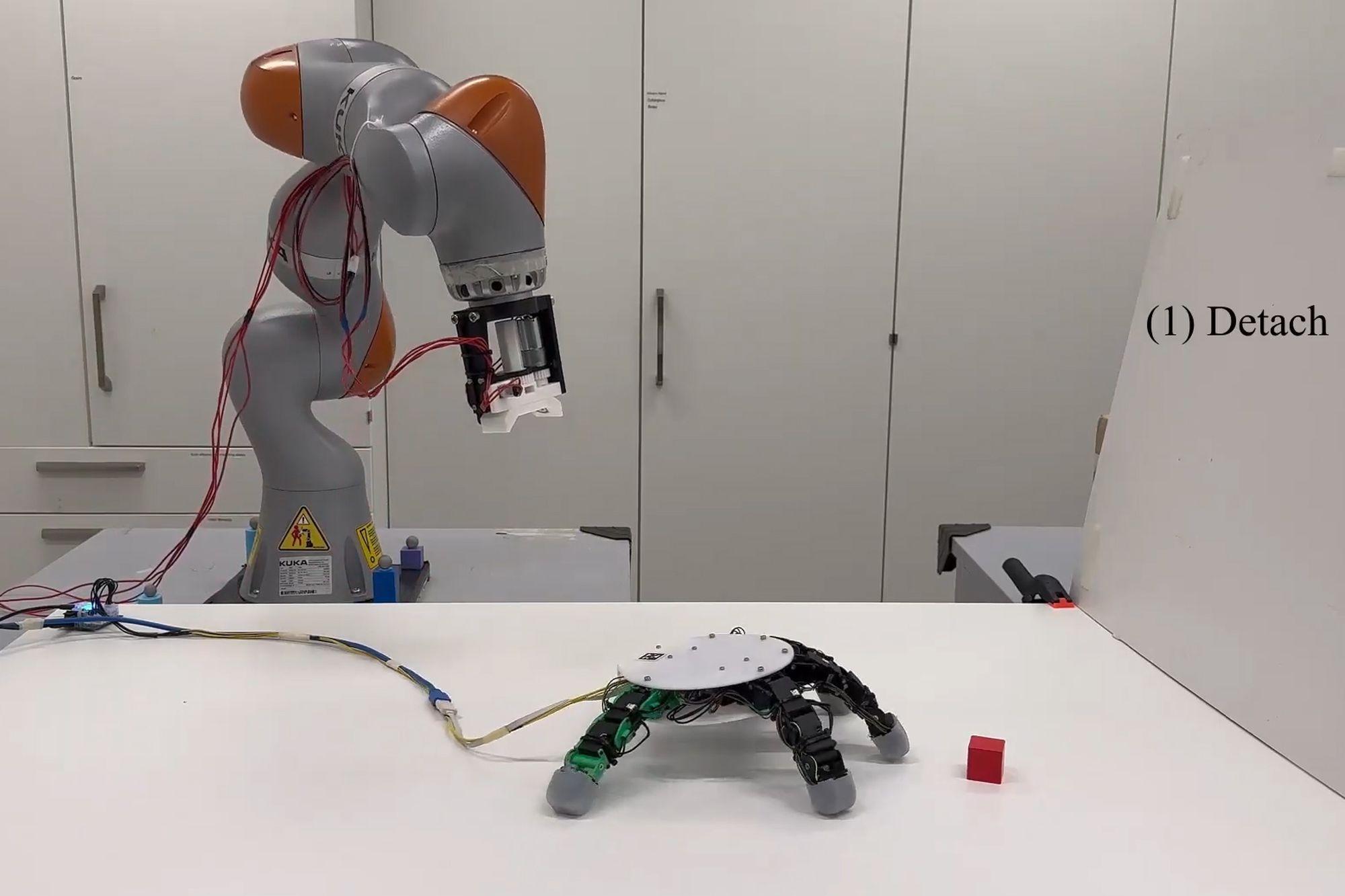

Robot with smart grip

NASA’s goal of conquering the Sun

Apple launches a new feature that makes it easier to use your phone while sitting on vehicle

Google Photos launches smart search feature “Ask for photos”

Roku streams live MLB baseball games for free

Gun detection AI technology company uses Disney to successfully persuade New York

Hackers claim to have collected 49 million Dell customer addresses before the company discovered the breach

Thai food delivery app Line Man Wongnai plans to IPO in Thailand and the US in 2025

Google pioneered the development of the first social networking application for Android

AI outperforms humans in gaming: Altera receives investment from Eric Schmidt

TikTok automatically labels AI content from platforms like DALL·E 3

Dell’s data was hacked, revealing customers’ home address information

Cracking passwords using Brute Force takes more time, but don’t rejoice!

US lawsuit against Apple: What will happen to iPhone and Android?

The UAE will likely help fund OpenAI’s self-produced chips

AI-composed blues music lacks human flair and rhythm

iOS 17: iPhone is safer with anti-theft feature

Samsung launches 2024 OLED TV with the highlight of breakthrough anti-glare technology

REGISTER

TODAY

Sign up to get the inside scoop on today's biggest stories in markets, technology delivered daily.

By clicking “Sign Up”, you accept our Terms of Service and Privacy Policy. You can opt out at any time.

Nhận xét (0)