Alibaba issues record convertible bonds of 4.5 billion USD to buy back shares

11:45 27/05/2024

3 phút đọc

Alibaba, China’s leading e-commerce company, has just raised 4.5 billion USD through convertible bonds – this is the largest amount of USD-denominated bonds ever issued by an Asian company. This money will be used to buy back shares and invest in areas such as artificial intelligence.

This bond has an interest rate of 0.5% and the conversion condition is that the stock price increases by 30% compared to the current price. This transaction was subscribed for 6 times more than the issued number, showing great interest from investors.

Alibaba is taking advantage of low interest rates and rising stock momentum to raise capital. The company needs money to invest back into its core and cloud computing businesses, which are losing market share due to the Chinese government’s tightening. At the same time, this issuance also shows that Alibaba believes that the current stock price is undervalued.

A portion of the proceeds will be used to repurchase 14.8 million American Depository Shares (ADR) once the deal is priced, in addition to future share repurchases.

Analysts say this is an opportunity for Alibaba to get cash abroad at preferential interest rates. This way, they can start buying back shares immediately, which benefits shareholders because the amount of buybacks will be larger than the amount of newly issued shares.

This is the largest convertible bond issuance in USD by an Asian company to date, surpassing Sea Ltd’s USD 2.9 billion. (Singapore) in 2021.

Convertible bonds allow companies to borrow money at lower interest rates than conventional loans, but can also affect stock prices due to their ability to convert into shares.

If the ADR price increases 30% from the current level, investors can exchange their bonds for Alibaba shares. This means Alibaba may need to issue more shares to deliver to investors, leading to the risk of stock dilution. To minimize this risk, the company has integrated a “capped call” feature into the bond.

Alibaba is looking to raise capital through convertible bonds, with low interest rates and high conversion prices. This is similar to the “bull call spread” investment strategy, buying call options at a price lower than the market price and selling call options at a higher price. Specifically, Alibaba will buy stock options at a price 30% higher than the current price, and sell call options at a price 100% higher than the current price.

This is a strategy that helps Alibaba reduce stock dilution pressure until the stock price rises much higher.

This activity takes place in the context that Chinese technology companies are recovering when the Chinese government has more supportive policies for the industry, and attractive stock prices attract investors. Previously, Alibaba’s rival JD.com also raised $2 billion through convertible bonds.

Experts say that Chinese technology companies are looking to mobilize USD from abroad to be flexible in buying back shares and investing abroad. However, the high conversion price of Alibaba bonds also makes some investors worry that the company’s growth recovery process may take longer than expected.

In recent months, Alibaba’s new leadership has repeatedly asserted that they believe the company is undervalued. Even co-founder Jack Ma and Vice Chairman Joe Tsai bought more Alibaba shares for the first time in many years.

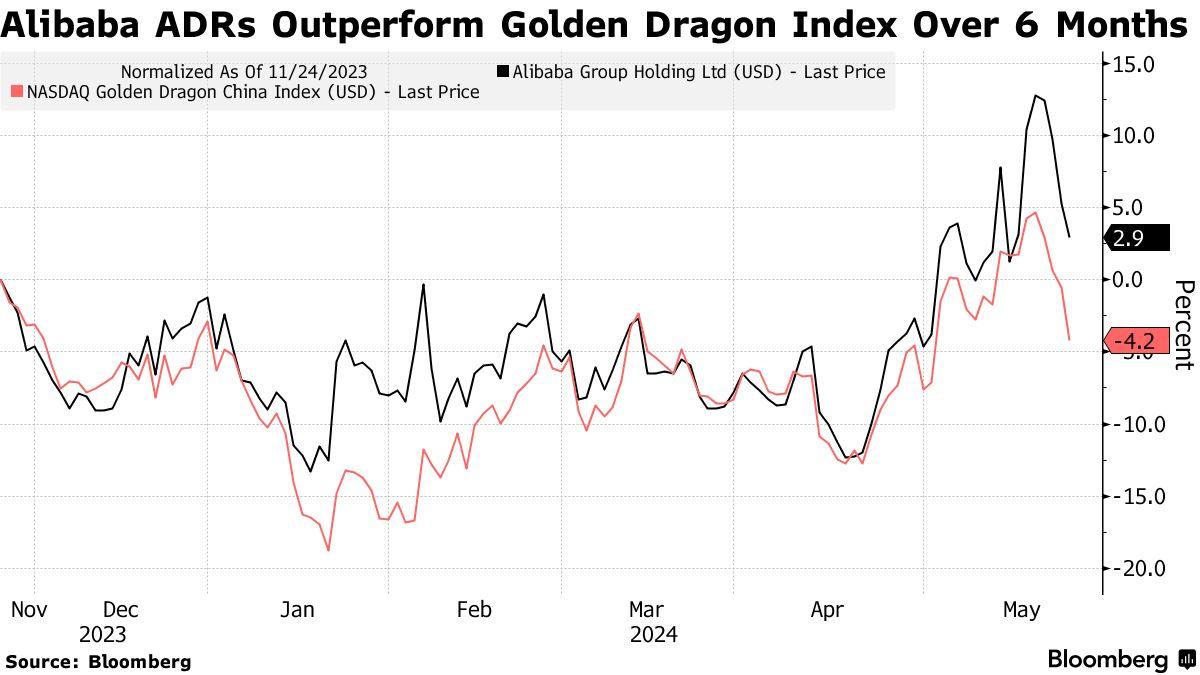

Alibaba’s stock price increased nearly 29% in May as of May 17. However, stock prices also fell slightly this week due to concerns about a price war in China’s AI market.

Alibaba is seeking to strike a balance between returning cash to shareholders and investing in existing and new businesses, including artificial intelligence (AI). The company is reinvesting in its core e-commerce business, while competing with state-owned rivals in cloud services.

In addition, Alibaba is also expanding into new markets such as Mexico and building more data centers in Southeast Asia.

Alibaba’s convertible bonds are offered with interest rates from 0.25% to 0.75%, and the conversion price is 30% to 35% higher than the market price. The issuance is expected to end on May 29, and investors can ask Alibaba to buy back their bonds in June 2029.

Từ khoá:

Bài viết liên quan

Palm Mini 2 Ultra: Máy tính bảng mini cho game thủ

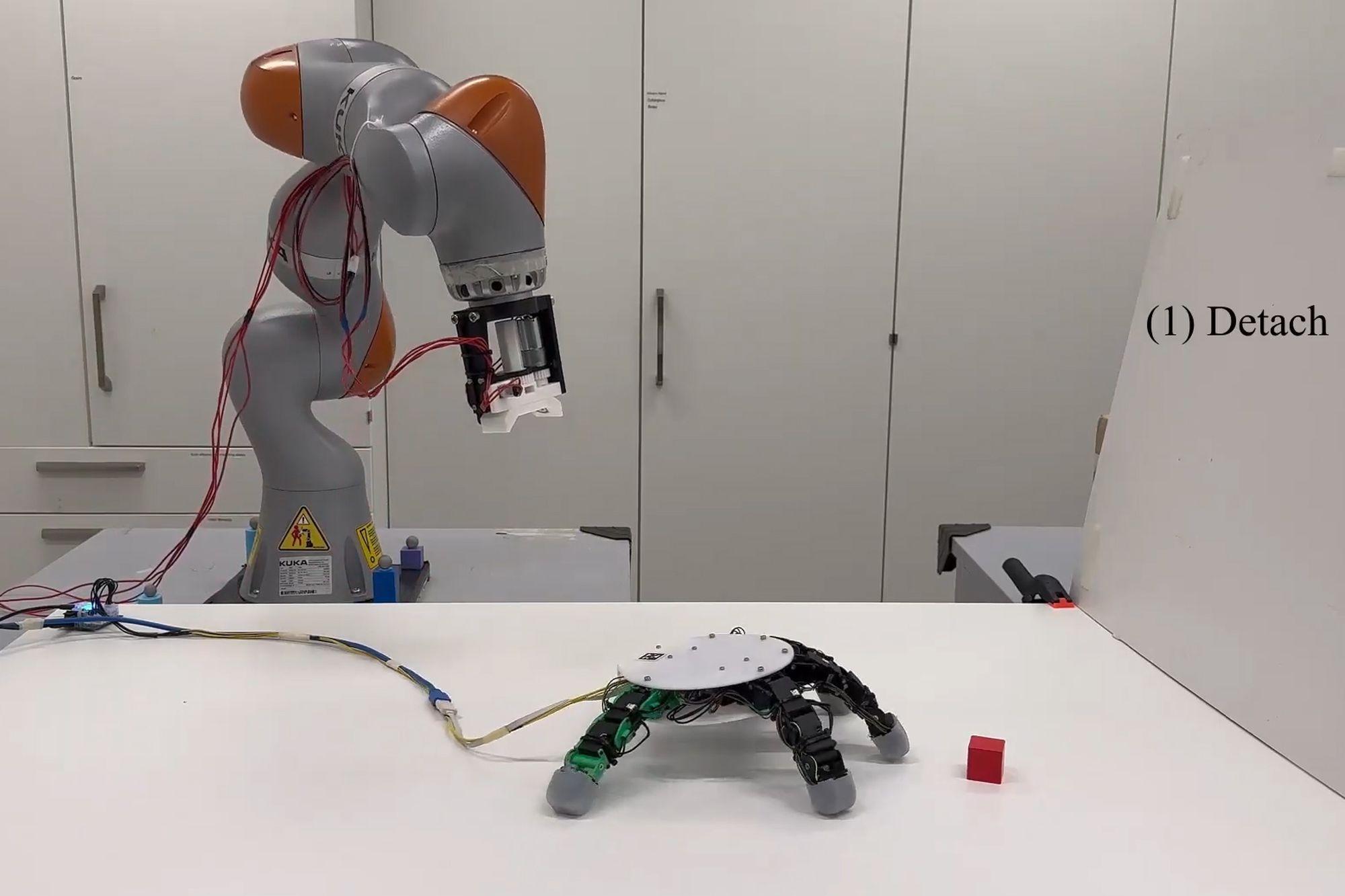

Robot with smart grip

NASA’s goal of conquering the Sun

Apple launches a new feature that makes it easier to use your phone while sitting on vehicle

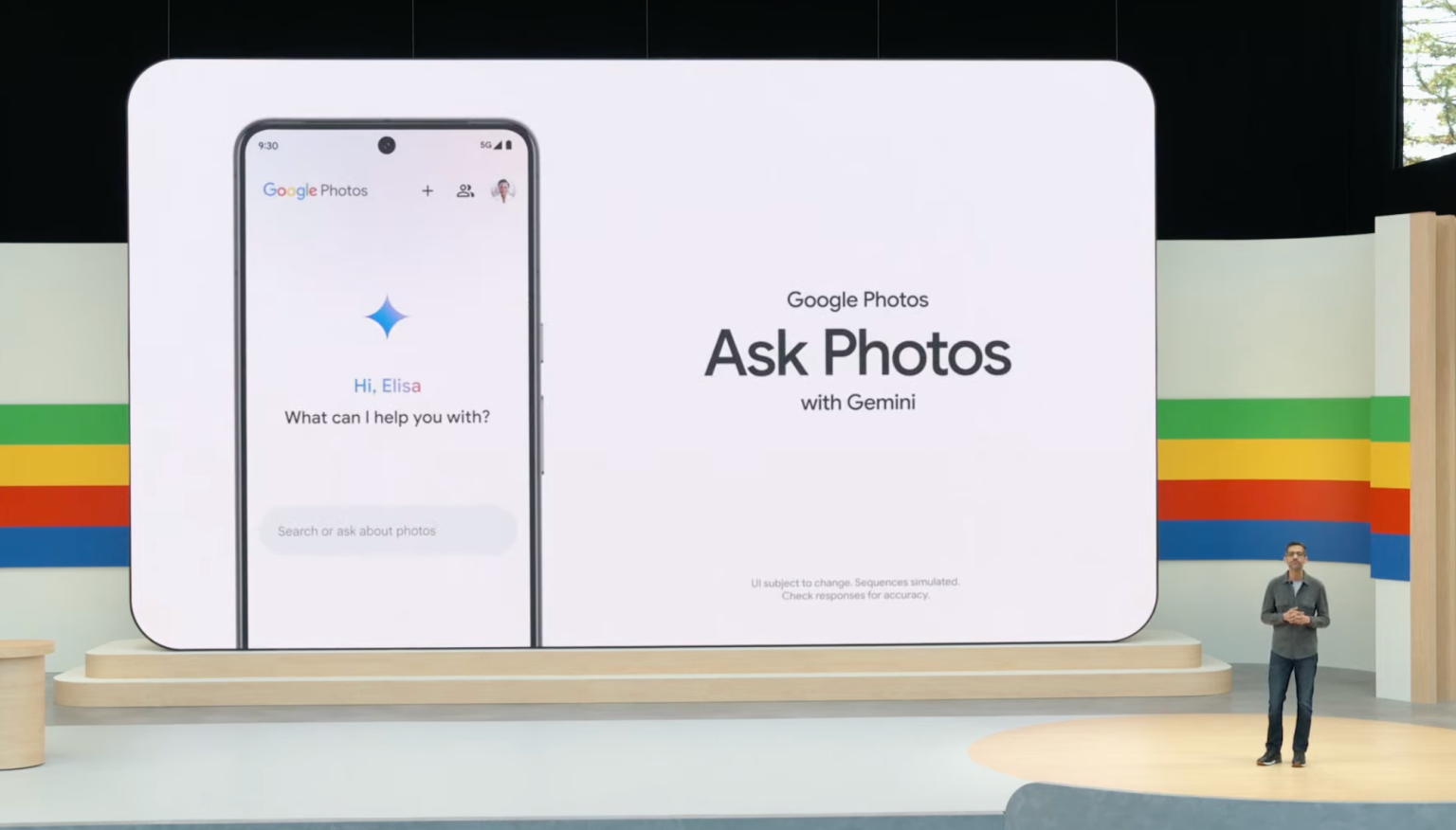

Google Photos launches smart search feature “Ask for photos”

Roku streams live MLB baseball games for free

Gun detection AI technology company uses Disney to successfully persuade New York

Hackers claim to have collected 49 million Dell customer addresses before the company discovered the breach

Thai food delivery app Line Man Wongnai plans to IPO in Thailand and the US in 2025

Google pioneered the development of the first social networking application for Android

AI outperforms humans in gaming: Altera receives investment from Eric Schmidt

TikTok automatically labels AI content from platforms like DALL·E 3

Dell’s data was hacked, revealing customers’ home address information

Cracking passwords using Brute Force takes more time, but don’t rejoice!

US lawsuit against Apple: What will happen to iPhone and Android?

The UAE will likely help fund OpenAI’s self-produced chips

AI-composed blues music lacks human flair and rhythm

iOS 17: iPhone is safer with anti-theft feature

Samsung launches 2024 OLED TV with the highlight of breakthrough anti-glare technology

REGISTER

TODAY

Sign up to get the inside scoop on today's biggest stories in markets, technology delivered daily.

By clicking “Sign Up”, you accept our Terms of Service and Privacy Policy. You can opt out at any time.

Nhận xét (0)